texas estate tax law

For persons age 65 or older or disabled Tax Code Section 1113 c requires school districts to provide an additional 10000 residence homestead exemption. Governmental agency of the state means.

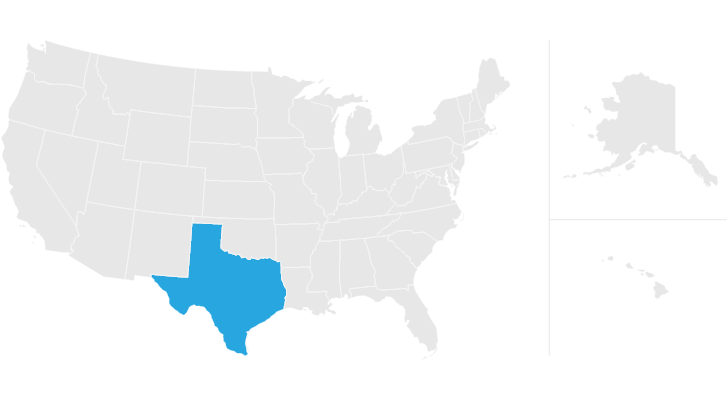

States With No Estate Tax Or Inheritance Tax Plan Where You Die

This booklet is basically a summary of a law book on the same subject by the same author.

. Tax Code Section 1113 d allows any taxing unit to adopt a local option residence homestead exemption. The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code. Taxpayers have a stronger voice in.

In Texas for example there is no limit on how much a landlord may. The Comptroller may adopt rules to administer. State Administration Section 503 SB 63 and HB 3786 add subsection d allowing the Comp-troller after giving notice to send and require submission of documents payments notices reports or other items elec-tronically.

Conduct of the Property Value Study a Definitions. Property and real estate law includes homestead protection from creditors. Senate Bill 1449 amends the Tax Code to increase the taxable value threshold below which incomeproducing tangible personal property held is entitled to a property tax exemption from 500 to 2500.

A The owner of real property sold at a tax sale to a purchaser other than a taxing unit that was used as the residence homestead of the owner or that was land designated for agricultural use when the suit or the application for the warrant was filed or the owner of a mineral interest sold at a tax sale to a purchaser other than a taxing unit may redeem the property on or before the. Property and real estate laws also include zoning regulations which determine which kinds of structures may be built in a given location. D This section does not diminish the rights of an adopted child under the laws of descent and distribution or otherwise that the adopted child acquired by virtue of inclusion in the definition of child under Section 22004.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. TAXABLE PROPERTY AND EXEMPTIONS. All Major Categories Covered.

Currently for 2021 the estate tax exemption is 117 million per person. With bi-partisan support Senate Bill 2 also known as the Texas Property Tax Reform and Transparency Act of 2019 passed the Legislature and was signed into law by Governor Greg Abbott. Adopted Rules The following proposals to repeal and replace administrative rule 94031 were filed with the Secretary of State for adoption on Feb.

Included in the Act are several key benefits for Texas property owners. Rather it is intended primarily to provide a simplified view of the property tax laws of Texas for tax assessors city councilmen school. PRACTICE AND PROCEDURE 9101.

A Closer Look The Matter of Texas Probate Taxes. Texas Probate Laws Definitions and Timelines. Handbook of Texas Property Tax Rules 1 Texas Property Tax SUBCHAPTER A.

Relationships between landlords and tenants. However if those trusts or plans were not made the only way estate assets can be distributed in Texas is through the probate. The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for the estate.

A All real and tangible personal property that this state has jurisdiction to tax is taxable unless exempt by law. And other matters pertaining to ones home or residence. This local option exemption cannot be less than 3000.

Ad Instant Download and Complete your Small Estate Forms Start Now. Texas has no state property tax. The Texas Constitution and statutory.

It is essentially a tax on the right to pass assets to another person. There is a 40 percent federal tax however on. REAL AND TANGIBLE PERSONAL PROPERTY.

Texas does not have a state-level estate tax but some other states do. Property in a decedents estate that is exempt from execution or forced sale by the constitution or laws of this state and any allowance paid instead of that property. In 2019 the Texas Legislature took a huge step to protect property owners.

C This section does not prevent an adoptive parent from disposing of the parents property by will according to law. Texas Property Tax Law Changes 2021 1 Tax Code Chapter 5. Added by Acts 2009 81st Leg RS Ch.

Published in the Texas Administrative Code. The probate process is not required in Texas if the decedent has set up a trust or family trust which in most cases helps their estate to avoid probate. GOVERNMENTAL AGENCY OF THE STATE.

Select Popular Legal Forms Packages of Any Category. From Fisher Investments 40 years managing money and helping thousands of families. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and collecting taxes.

When the fair market value of the estate is worth more than the recognized exemption the estate tax is owed. House Bill 3971 amends the Tax Code to require a chief appraiser who is determining the market value of residential real property located in an area that is zoned or otherwise designated as a historic district under municipal state or federal law to consider the effect on the propertys value of any restriction placed by the district on the property owners. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

The following words and terms when used in this subchapter shall have the following meanings unless the context clearly indicates otherwise. TAXABLE PROPERTY AND EXEMPTIONS. Although the 25 chapters of the larger work correspond directly to the chapters of the summary this publication is not a law book in the usual sense.

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

How Long To Probate A Will In Texas Legalzoom Com

Talking Taxes Estate Tax Texas Agriculture Law

Texas Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

States With No Estate Tax Or Inheritance Tax Plan Where You Die